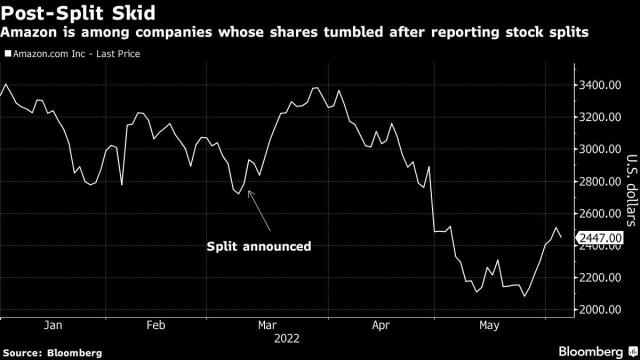

Today denoted the principal exchanging day following Amazon’s (AMZN) 20-for-1 stock split that the organization reported on March 9. Amazon shares were revalued to $120 per share, in the wake of exchanging great above $2000 per share preceding the stock split. Shares shut 2% higher at $124.80 in Monday exchanging, subsequent to hitting a high of $128.70 from the get-go in the meeting. Shares had risen practically 8% in the five days paving the way to the split, regardless of the way that the stock split makes no additional incentive for investors.

Google’s Alphabet (GOOGL) likewise declared a 20-for-1 stock split that is set to produce results in July, and Tesla (TSLA) reported it expects to divide its stock, in spite of the fact that it hasn’t uncovered the proportion or timing of its parted.

One expected benefit of the parts is that they could make the offers bound to be added to the Dow Jones Industrial Average. Adding excessive cost stocks to the Dow is generally an issue on the grounds that the record is weighted by cost, so a similar rate change in an excessive cost stock moves the file more than for one with a lower cost. A four-digit stock would in a split second give it the most impact in the list. The stock split will likewise make Amazon’s stock more reasonable to retail financial backers.

Amazon’s stock split comes at a crucial time for financial backers. Portions of AMZN are down 23% year-to-date, and down 20% in the previous year. While the split doesn’t change the worth of the offers, a lower cost might draw in more cost cognizant purchasers who have been standing by to claim the stock.